The National Retail Federation (NRF) has forecast that cargo imports at major container ports in the US will level off and decline slightly in the second half of 2022, with an estimated 1.5% year-on-year decline. As the U.S. economy slows, imports are likely to fall further in 2023.

“Retail sales are still growing, but the economy is slowing and that is being reflected in goods imports,” Jonathan Gold, NRF vice president of supply chain and customs policy, said in the Global Port Tracking Report (GPT) released Monday.

“The heady days of import growth are fading fast,” said Ben Hackett, founder of consulting firm Hackett Associates and co-publisher of GPT. Looking ahead to the coming months, freight volumes are expected to decline from 2021 and the decline is expected to increase further through 2023.”

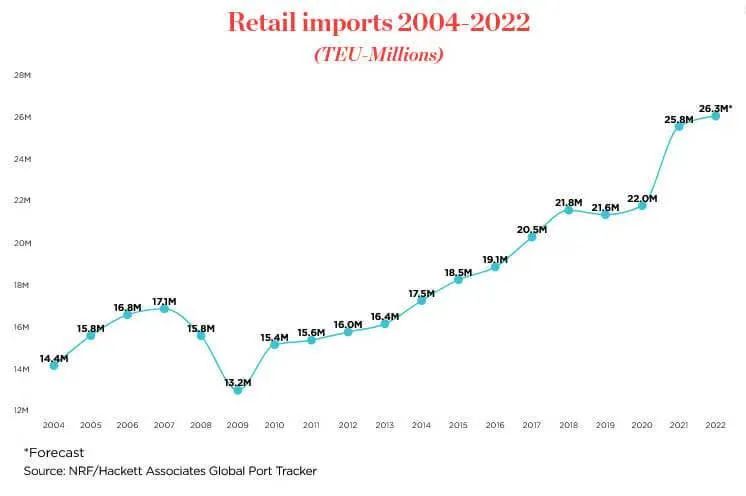

Despite the weakness in imports, GPT forecasts full-year retail imports at US container ports will still be 2% above the record level of 25.8 million TEU in 2021. Imports at major container ports in the United States rose 5.5 percent to 13.5 million TEUs in the first half of 2022 from the same period last year. They are demanding total imports of 26.3 million TEUs this year.

Retailers are moving quickly to import fall and holiday merchandise to make sure those seasonal items get to store shelves on time. Last year, some holiday goods didn’t reach stores until early 2022 due to supply chain bottlenecks and have been sitting in warehouses ever since.

GPT expects imports to level off from August. The NRF forecast that the monthly decline in retail imports would range from about the same as last year to a decline of nearly 4%. The biggest declines are expected in August, October and December. Imports fell 3 percent year-on-year in August 2022 from 2021, following a 0.4 percent increase in September, a 3.9 percent drop in October, a 2.7 percent drop in November and a 3 percent drop in December.

The NRF also attributed a possible slowdown in retail imports in the traditionally busy third and fourth quarters to “many retailers bringing in goods early and moving them to East Coast and Gulf Coast ports to avoid any potential disruptions related to contract negotiations.” Those earlier-than-usual shipments helped boost shipments in the second quarter, diverting some shipments that would have come in the second half of the year, according to the NRF.

Consumer spending, meanwhile, is expected to grow this year. ”The NRF continues to forecast retail sales growth of 6 to 8 percent in 2022 over 2021,” GPT said. ”Sales in the first half of this year were up 7 percent.”

The NRF also noted that two uncertainties that could affect supply chain liquidity remain – the outcome of contract negotiations between the International Longshore and Warehouse Union (ILWU) and West Coast Marine terminal employers, and rail worker negotiations.

“With the important holiday season approaching, it was critical that these two rounds of negotiations were completed without disruption to the supply chain,” said Jonathan Gold.

During the epidemic, you need to use Lanhine’s face mask.

Post time: Aug-12-2022